Introduction

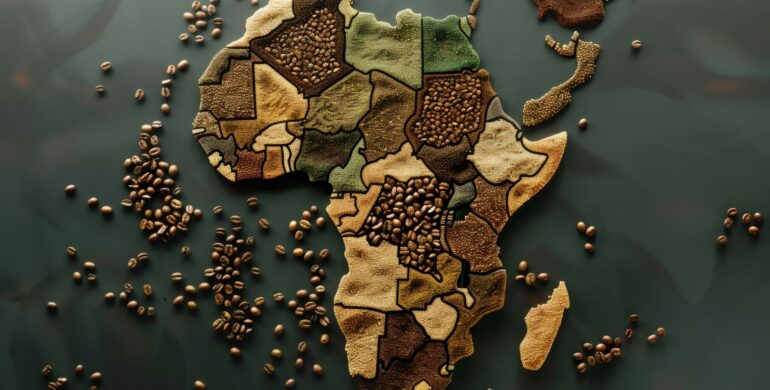

Food security remains one of Africa’s most pressing challenges. With a rapidly growing population, changing climate, and increasing global market volatility, the continent’s agricultural systems are under immense pressure. Smallholder farmers, who produce up to 80% of Africa’s food supply, often struggle to access affordable finance, leaving them vulnerable to shocks and limiting their capacity to scale production. Rural finance is a powerful tool for strengthening resilience. By providing farmers with the resources to invest, adapt, and recover, financial systems can safeguard food security while driving inclusive economic growth.

1. The Link Between Finance & Food Security

Access to finance enables farmers to purchase inputs such as seeds, fertilizer, and equipment that improve productivity. It also allows them to invest in storage facilities, irrigation, and post-harvest technologies that reduce losses. Without reliable financial services, smallholder farmers remain trapped in cycles of low productivity and food insecurity. By bridging this gap, rural finance helps ensure a consistent food supply, stabilizes rural economies, and reduces dependence on external food aid.

2. Coping with Climate & Market Shocks

African farmers are increasingly exposed to unpredictable rainfall, droughts, floods, and pest outbreaks. These shocks often result in significant losses and threaten national food reserves. Financial products such as index-based crop insurance, credit guarantees, and climate-adaptive loan schemes allow farmers to better manage risk and recover quickly after disruptions. Additionally, access to finance helps farmers diversify into resilient crops and technologies, strengthening long-term adaptation strategies.

3. Supporting Smallholder Farmers & Cooperatives

Most smallholders lack collateral and formal credit history, making traditional banking services inaccessible. Innovative rural finance models—such as group lending, savings cooperatives, and mobile-based credit systems—have emerged as practical solutions. When organized into cooperatives and linked to financing, farmers gain collective bargaining power, access to markets, and better prices for their produce. These models not only empower smallholders but also contribute to broader national food security goals.

4. The Role of Policy & Partnerships

Effective rural finance requires an enabling policy environment and strong partnerships between governments, development partners, and the private sector. Policies that reduce barriers to agricultural lending, combined with blended finance and risk-sharing mechanisms, encourage greater investment in the sector. AFRACA continues to serve as a platform where financial institutions, policymakers, and development actors collaborate to design solutions that strengthen resilience across Africa’s food systems.

5. Looking Ahead

As Africa works towards achieving the Sustainable Development Goal of Zero Hunger, investing in resilient rural finance systems will be critical. Expanding access to credit, insurance, and savings services—while integrating digital technologies—can empower farmers to withstand shocks, increase production, and secure the continent’s food future.

Conclusion

Resilient food systems begin with resilient farmers. Rural finance is not merely a support service; it is a cornerstone of agricultural transformation and food security. By strengthening financial inclusion in rural communities, Africa can ensure sustainable livelihoods for farmers and guarantee a more secure food supply for generations to come. AFRACA remains committed to advancing rural finance innovations, fostering partnerships, and equipping its members with the tools to build resilience and safeguard Africa’s food security.