Digital financial platforms are an essential part of the digitalization agenda developed to enhance financial inclusion in developing countries. At the forefront of the digitalization agenda are FinTechs, AgTech companies and other solution providers that are constantly innovating and offering improved and tailored solutions to their customers. By bringing together key practitioners and partners in the space, the training workshop will take a deep dive into some of the innovations and tackle issues around digitalization in the rural and agricultural finance landscape.

In recent years, the mobile phone ecosystem is at the heart of FinTech innovations, powering new innovative solutions, and financial collaboration between financial and non-financial actors and enhancing user experience. New actors such as Mobile Network Operators, Fintech and AgTech companies are providing new financial services and products through innovative use of technology and big data. This is making rural populations bankable through dramatically reducing the cost of delivery.

Comparably with other sectors, growth and adoption of FinTech and AgTech innovations in the Rural and Agricultural Finance (RAF) landscape has been slow. While payment systems generally have recorded remarkable growth, a number of areas still require extra focus for example, scaling up DIG4RAF innovations, interoperability, cost implications of digitalizing financial systems for rural lenders, limited use of data to develop predictable credit scores for farmers, creating efficient digital platforms in unstructured value chain sectors among others.

TRAINING OBJECTIVES

- The training will sensitize participants on recent technological developments in rural and agricultural finance.

2. Build capacity of financial sector players on the building- block considerations for digitalization.

3. Identify critical success factors for deploying FinTech and AgTech Innovations in RAF through experience sharing with key stakeholders and practitioners.

4. Enable participants to learn and evaluate the experiences shared by practitioners.

TRAINING METHODOLOGY

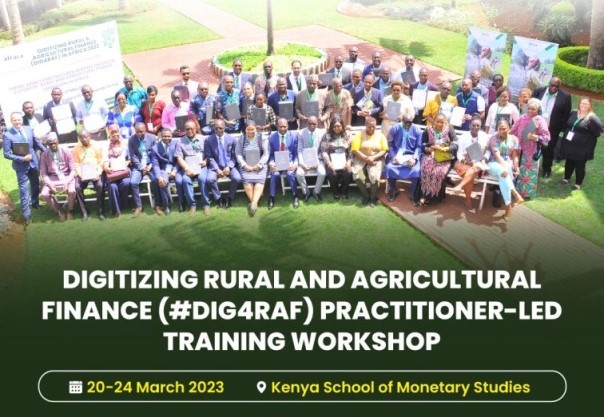

The training workshop will be facilitated by lead trainer, Mr. David Cracknell with support from other key practitioners. There will be five (5) training modules prescribed alongside topical issues in digital financial services related to the rural and agricultural landscape.

- Module 1: Policy Considerations in Digital Financial Services.

- Module 2: Analysis of core banking system options for micro lenders: Why Shared platforms make sense

- Module 3: Building Financial Synergies with AgTechs

- Module 4: Digital Credit appraisal and assessments innovations in Agricultural lending

- Module 5: Digitizing Agricultural Value Chains

The training workshop targets representatives from financial service providers deploying digital finance or contemplating digital transformation within their respective institutions, policy makers, implementers and investors in the field of digital finance solutions, development partners, academicians, public and private funders, representatives from Fintech and AgTech companies as well as Agri SMEs.

TRAINING WORKSHOP FEE

The investment for the training is US$ 800 for AFRACA members and US$ 1000 for non-members. For the institutions sponsoring up-to three (3) participants there will be a special discounted rate of 25% per participant. This training fees will cover the facilitators’ fee, meals during the training, training materials as well as other administrative costs. The training fee should be remitted by bank transfer to AFRACA to the account outlined below.

AFRACA Bank Details

Account Holder: African Rural and Agricultural Credit Association

Bank: Equity Bank Limited

Branch: Equity Centre Branch

Swift Code: EQBLKENA

Account No: 0810297232884

For inquiries or clarifications please contact: afraca@africaonline.co.ke or call 254726080454