A joint webinar was organized by the Food and Agriculture Organization (FAO), African Rural and Agricultural Credit Association (AFRACA) and the Global Network for capacity building to increase access of financial services to small-scale fisheries (CAFI-SSF Network), to validate the recently concluded study findings with stakeholders particularly financial service providers that includes both banking and insurance organizations within east and west Africa region. The webinar was organized on 18 August 2021 and attended by more than 60 stakeholders from east...

In developing countries, almost 116 million people are employed in the fishery sector with 90% of them being Small Scale Fishers (SSF). The sector contributes 2.39 million jobs, 74 million tons and trade revenue amounting to 164 million USD. Access to finance is still a menace to SFF who need adequate funding to scale up the fishing business, replace vessels/engines at the end of their cycle, meet safety and quality demands and; comply with government regulations that promote sustainable fishing...

AFRACA in collaboration with the UN’s Food and Agriculture Organization and State Department for Fisheries, Aquaculture & the Blue Economy held the National Small-Scale Fisheries and Finance Stakeholders’ Workshop from 11-12 August 2021 at Beaumont Resort, Mombasa, Kenya. The workshop aimed to support fishing enterprises in Kenya access financial services and to share findings of a baseline study commissioned by AFRACA & FAO on Credit, Microfinance & Insurance needs of fishers in Mombasa, Kwale and Kilifi counties. The Chief Guest Mrs....

Deadline: 6th August 2021 The Centre for Financial Inclusion will host the 7th financial inclusion week from 1-4 November 2021. This year’s theme, “Inclusive Finance: Driving Prosperity in an Era of Uncertainty” is based on the ongoing impact of COVID to financial service providers. The financial Inclusion week will bring together different financial actors across the globe to share their experiences/lessons on how they continued restructuring loans, providing information on the health crisis as well as how they continued to support...

The African Rural and Agricultural Credit Association (AFRACA) is saddened to receive news of the passing of Mrs. Jema Hillal on 11/7/2021. Mrs. Hillal was the Senior Agribusiness Manager at CRDB Bank Plc (Tanzania) and was a very active member of the AFRACA Network who shared her expertise with other members on rural and agricultural finance. Our thoughts and prayers are with the family, friends, and colleagues at this difficult time. Her absence will really be felt by the Association....

Handmade canoes propelled by paddles or sail power depict the typical equipment features of the artisanal fisherfolk plying the Kenyan coast. Only a few fisherfolk have motorized boats enabling them to take the opportunities offered by offshore fishing. Majority of artisanal fisherfolk are disempowered and unable to access any of the largely untapped offshore pelagic resources. To address this, AFRACA and FAO collaborate to support provision of ‘Technical services in the development of credit programmes to finance private sector innovation...

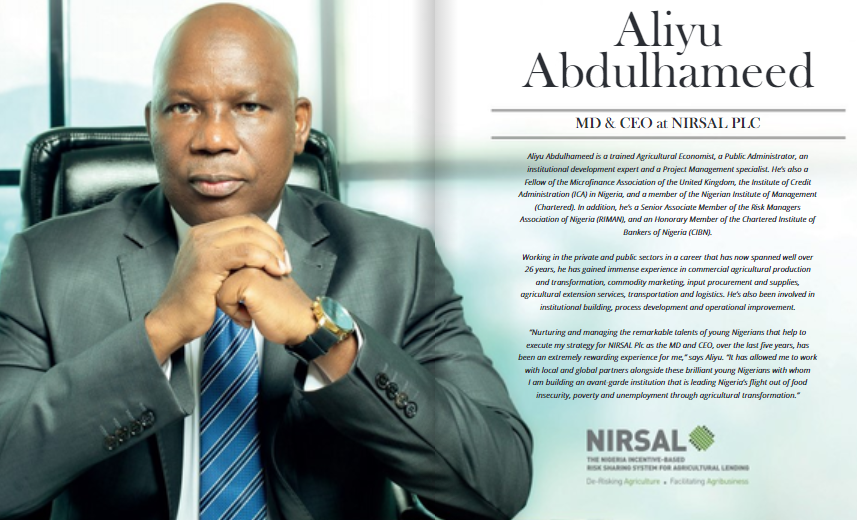

AFRACA congratulates Mr. Aliyu Abdulhameed, MD & CEO Nigeria Incentive-based Risk Sharing System for Agricultural Lending (NIRSAL) who recently was recognized as one of the Best Global CEOs according to the CEO Today Magazine Global Awards. NIRSAL plc is a non-bank financial institution formed in 2023 to derisk agriculture, fix broken agricultural value chain, institutionalize incentives for agricultural lending and stimulate flow of finance and investment into the agricultural value chains. Some of the innovative and sustainable solutions in agriculture by...

The African Rural and Agricultural Association (AFRACA) is saddened to announce the passing of Mr. Gilead Musinga who died on 25th June 2021 after a short illness. Mr. Musinga was the Manager, Strategic Partnerships, Marketing Department at the National Savings and Credit Bank (NATSAVE). Mr. Musinga was an active member of the AFRACA network who played a key role in our major activities/programmes as well as shared his extensive knowledge on rural and agricultural finance. We will miss him dearly at AFRACA...

Le financement à long terme (LT) est essentiel pour guider les investissements dans le renforcement des infrastructures et des capacités agro-industrielles, des technologies améliorées et des équipements pour rendre l’agriculture plus productive, efficace, rentable et résiliente. Cependant, le financement à long terme aux PME et aux petits exploitants agricoles est plus limité que le financement court terme (CT) traditionnel des cultures, de la pêche et de l’élevage, ainsi que le financement LT pour les PME dans d’autres secteurs. Le déficit...

The African Rural and Agricultural Association (AFRACA) has formed an Impact Task Force to deliberate on specific indicators that will be used by the Association to measure the impact of its members lending activities to rural smallholder farmers in Africa. The three-year initiative was launched during the 21st AFRACA General Assembly held in February 2021 in which members collectively agreed to develop a Financial Indicator Framework and a single database of members credit data that will assist regulators and key industry...